Make smart money moves using our advanced spend management and expense allocation software powered by artificial intelligence.

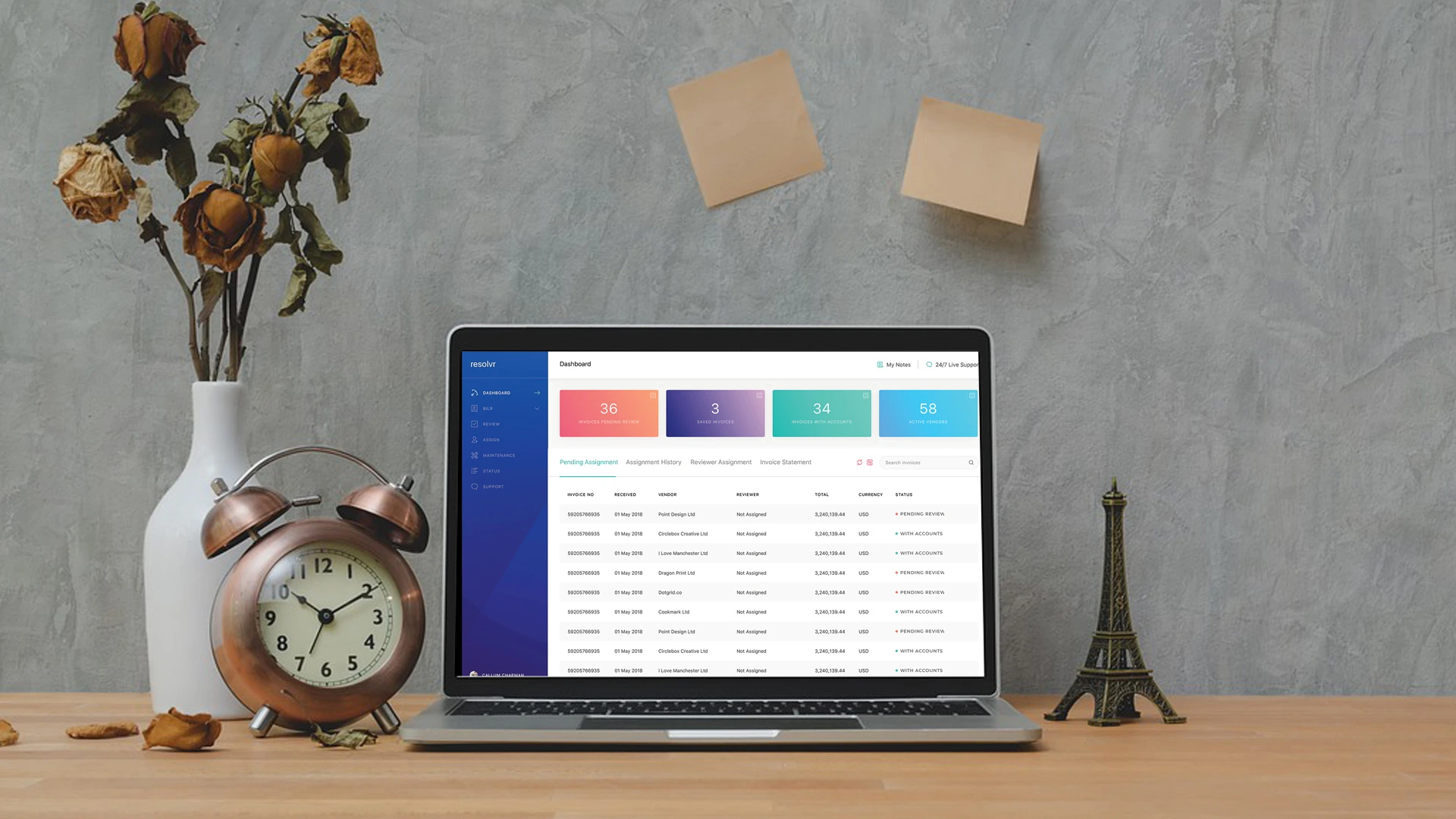

Managing Finance is Faster, Better & Easier with Resolvr-GRC

Automate your time-consuming tasks by replacing paper, spreadsheet, PDF, and other manual processes with high-precision AI software. Resolvr-GRC transforms how you handle money by analyzing data, predicting trends, and optimizing expenses.

The Birth of Resolvr-GRC

In 2017, a top global hedge fund had a problem. Being an expert in managing money, these folks had complex needs to handle huge financial bills and how these must be accurately allocated across funds, sub-funds and legal entities. They reached out to us for collaboration.

Our joint teams embarked on creating a tool that could automate complex financial management tasks. After many refinements and tests, an end-to-end spend management software was born. We named it Resolvr as it resolves all financial management problems, including regulatory compliance, risk mitigation and workflow management to govern the expense allocation process.

The Features of Resolvr-GRC

Digital Environment:

No more printed documents, as you can store, share, and work with information digitally using faster and more convenient processes.

Collaborative Tools:

Team members and vendors work together on projects, edit documents live and communicate seamlessly, irrespective of their location.

Compliance Dashboard:

Get an overview of how well you follow the rules and legal requirements (like the Dodd-Frank Act) and required security measures.

Don't get a fine from the SEC:

A growing number of funds have been hit with fines from the SEC for mis-allocation of expenses. While this element of compliance may seem low priority, greater scrutiny and attention by regulators is very real.

Fast Integration:

Resolvr-GRC can easily connect and work with existing software and systems without complicated setup or configurations. API or SFTP options are available.

Increase Revenue:

AI-powered expense optimization increases profit margins and frees time that would otherwise be taken up with manual paperwork to focus on higher-value tasks.

Meet Resolvr-GRC

Mitigate compliance risksResolvr-GRC ensures that client funds' expense allocation and apportionment is fully compliant with the Dodd-Frank Act, avoiding SEC misapportionment fines.

Automate and digitize processesResolvr-GRC automates inefficient human-manual tasks that are wasting time and money. Immediate, authorized access to information, rapid and efficient processing and the ability to utilize staff more efficiently are just some of the benefits.

Satisfied Clients across the globe

Brit Insurance

Brit InsuranceSystem enables us to get a much clearer understanding down to transaction-level detail of our spend across the entire business.

NYCM Insurance

NYCM Insurance[...] we were able to take the program from the planning phase to fully functional in less than two weeks due to their efficient on-boarding.

Arthur J. Gallagher & Co

Arthur J. Gallagher & CoWe looked around quite a bit when searching for a good fit [...] we decided on LSG and are extremely pleased with our decision.

Rockville Risk Management

Rockville Risk ManagementLSG is easy to navigate even if you are new to the system. Client relations staff is awesome as they are responsive and timely.

Transform Your Financial Life With Resolvr-GRC

At LSG, we create innovative robust technical solutions that disrupt the status quo for the financial industry. Try Resolvr-GRC, and you'll realize the way you do finance will never be the same.

-

Become Flexible:

You have more control over your finances and are able to adapt quickly to the changing market. Resolvr-GRC will suggest efficient strategies and reallocate resources to meet your needs.

-

Stay Ahead Of The Game:

With access to the most advanced financial tools, you can make smarter moves that lead to significant profit. Keep your competitors wondering about your intelligent decisions.

-

Enhance Financial Relationships:

The software fosters team communication by providing a space where you and all other stakeholders can easily work and share ideas for efficient functioning.

-

Wealth Management Strategy:

With accurate data analysis, the software helps you make important strategic decisions by identifying growth opportunities and managing spend and resources much more effectively.

Frequently asked questions

EXPENSE ALLOCATION SOFTWARE

EXPENSE ALLOCATION SOFTWARE  EXPENSE ALLOCATION SOFTWARE

EXPENSE ALLOCATION SOFTWARE