How Can Insurers Use Predictive Analytics to Reduce Claims Cost?

Published by Joakim Hjønnevåg on Jan 19, 2023

These days, claims are being filed in unprecedented quantities. This has in turn led to increased investment in utilizing accumulated claims data efficiently as a way to gain an edge in the policy pricing and claims handling processes. Across industries, data has become the digital oil, and that's no different as it relates to insurance and specifically claims. In fact, insurers can gain a strong competitive advantage by leveraging claims data within a predictive model, identifying trend lines and risk to mitigate impact to the business.

Predictive analytics can assist in-house legal departments and claim adjusters in forecasting risk, budgets and the likelihood of litigation, helping them make more informed decisions in the claims life cycle. Evolutions in machine learning and artificial intelligence, packaged into a predictive model, can now unravel intricate data patterns and trends. This is made possible by analyzing and digesting large sets of claims data automatically — something unheard of until now.

Data is an integral part of inter-departmental interactions at insurers. It forms a bridge of communication between adjusters, managers and the in-house legal department. Looking at data can mean all the difference between a successful outcome and a large loss, e.g. through not detecting opportunities for early settlement or not knowing whether a claim will become litigated until the last moment, leading to inefficient panel counsel engagement. Communication and data visibility at every step of the claims process is vital for reducing costs and improving outcomes.

Mounting Claims Bode Well for Predictive Analytics

Claims are rising for two main reasons. Firstly, there are more policies in existence today. The second reason is rooted in technology. Underwriters are leveraging big data, on a consistent basis, to craft pricing algorithms. These pricing algorithms are then used to target individual policy prices.

As a result, the number of insureds has grown exponentially. The number of insureds that carry higher risks has also grown. Though insuring this particular batch of customers can be cause for concern, pricing policies based on the output of a predictive model can mitigate the risk.

Risk can be mitigated by looking at previous liability claims and identifying trend lines and conditions that lead to unfavorable outcomes, and pricing new policies accordingly. Additionally, a predictive model can also be used for processing claims, activated at FNOL for initial claims assessment and highlighting high value losses, forecasting budgets and flagging claims likely to become litigated. Other insights gained from a predictive model can include the following:

- What is the likely settlement amount that would be accepted?

- What is the likely total cost if litigated?

- Which panel firm should be selected for a desirable outcome?

- ...and much more!

Selection of Panel Firms and Counsel Using Predictive Analytics

In addition to highlighting areas of risk and enabling claims to be triaged to the correct adjuster depending on severity, predictive analytics can also help insurers in selecting panel counsel when litigation is inevitable. Insurers traditionally rely on existing relationships with panel counsel, with the assessment of which counsel to work with often depending on the adjuster working on a claim. Large claims are typically referred to the big, expensive panel firms — but how do insurers know that this is the best fit for a specific claim?

Predictive analytics can identify and suggest panel firm engagement based on the facts of a claim and its specific qualities, e.g. practice area, jurisdiction, business line etcetera. Additionally, a predictive model can help evaluate the performance of activated panel counsel and the effectiveness of each engagement. This knowledge, coupled with insights into claim probabilities and likelihoods, can enable insurers to make concrete decisions about litigation strategies.

How Can Predictive Analytics Be Integrated?

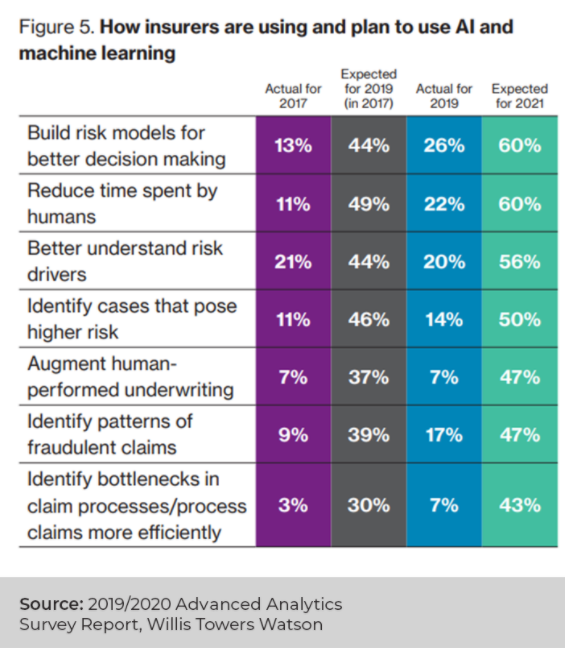

Some insurers are opting to build their own predictive models, with the 2019/2020 Advanced Analytics Survey by Willis Towers Watson finding that 26% of North American P&C insurer respondents were using risk models based on AI and machine learning in 2019.

However, this same report also found that 45% of all respondents said the main problem hindering the use of advanced analytics within their organizations was focused around information bottlenecks, with problems arising when people and systems need to interact to leverage the analytics. Additionally, 37% of respondents also highlighted a lack of sufficient staff to analyze data as an issue.

Though these are valid issues, they are not impossible to circumvent. Typically, problems can arise when the outputs of a predictive model need to be analyzed by data analysts in order to be utilized effectively, and then have to be forwarded along to the right person at the right time in the process. This, as one can imagine, causes a bottleneck.

An alternative is to integrate predictive analytics within the claims handling workflow, available from within claims management systems or litigation management platforms that adjusters and in-house counsel already use frequently, if not every single day.

This approach is one that we've taken with our Mercury ELM platform, integrating predictive analytics into the claims litigation and panel management workflow. The outputs of our predictive model are fed into a dashboard hosted within the system, as well as are pushed directly through notifications when certain conditions are met, e.g. if a new claim has an especially high risk profile.

The result of this is that insights are easy to use as the barrier to finding and using the information is low. This can be especially helpful for self-insureds that work with third-party administrators and wish to leverage predictive analytics but are uncertain about how to push the data to the TPA's adjusters efficiently. With our platform, this is not an issue as "smart insights" into a claim's probabilities and risk are highlighted throughout the entire claims handling workflow and does not have to be analyzed or retrieved to be understood and used, nor do the TPA's adjusters need to look at a separate dashboard or platform to find information about a claim.

We work with insurers, self-insureds and third-party administrators directly to improve the claims litigation and panel management process with predictive analytics. If you're interested in learning more, click here. Alternatively, email us at info@lsg.com or call us at +1 386 853 3099.